Brisbane housing continues to maintain a strong showing during Covid.

Throughout the entire Covid experience, property in general has remained strong, with Queensland leading the charge in many areas. Housing values in the Queensland capital are currently only 0.5% under the pre-Covid high point. The unit market however, remains the usual drawback.

Rentals see some difference with house rents rising slightly since the onset of Covid, however unit rents have dropped just over 1.5%. The drop in unit rents has been seen Australia wide and can be attributed to three main factors:

- The loss of many jobs in the hospitality industry, historically staffed by young graduates and school leavers, has seen many of this demographic leaving their shared units and heading back home to live with their parents.

- A large number of short term rentals such as Airbnb etc, now have little to no tenancy due to the near complete shutdown of the tourism industry and greatly reduced business travel. These properties, a vast number of which are units in the major tourist areas and CBD, are now on the market as long term rentals.

- The total shutdown of overseas migration has seen the demand for unit rentals drop drastically. In total, this situation has created a large over-supply and greatly reduced demand for units. The drop in unit rentals also results in reduced interest from investors, also putting pressure on sales and prices.

So, is it southern migration that is keeping the housing market strong?

A different type of migration, that being internal migration from Australia’s southern States to Queensland has always been a positive historical factor in the rapid growth of south east Queensland. “Mexicans” moving one or two borders north for retirement has been almost a compulsory addition to the Australia superannuation scheme plan.

Covid, however, along with Queensland’s ability to handle the situation better than others, seems to have accelerated the desire of many to make the move a little earlier. Recently, there have been a number of indications of increased interest from the south with increased enquiries. Only last week, a Brisbane suburban mortgage broker reported three random “out of the blue” enquiries from Melbourne, regarding property loans for Brisbane.

Such factors give vendors confidence to maintain higher prices and leave properties off market awaiting advances via Melbourne and Sydney Buyers Agents.

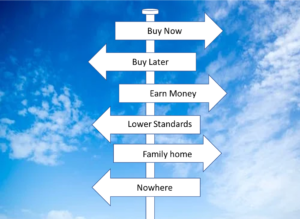

Get in ahead of the rush from the south before it becomes a stampede. If it becomes a stampede, properties will be scarce and prices will skyrocket.

If you want access to the many currently off-market, pre-market and post-market properties in Brisbane, in addition to well negotiated cheaper prices, contact PPBA for your FREE consultation. The first step in buying your property is coffee. Our shout.